Earthquake insurance is an important safeguard for homeowners, especially in regions where earthquakes are a real concern. While many standard homeowners policies don't cover earthquake damage, this specialized coverage is designed to protect you from the financial strain of unexpected seismic events. Knowing that you're covered in the event of the unpredictable helps you move forward with confidence, knowing you've taken the right steps to protect your home and your future.

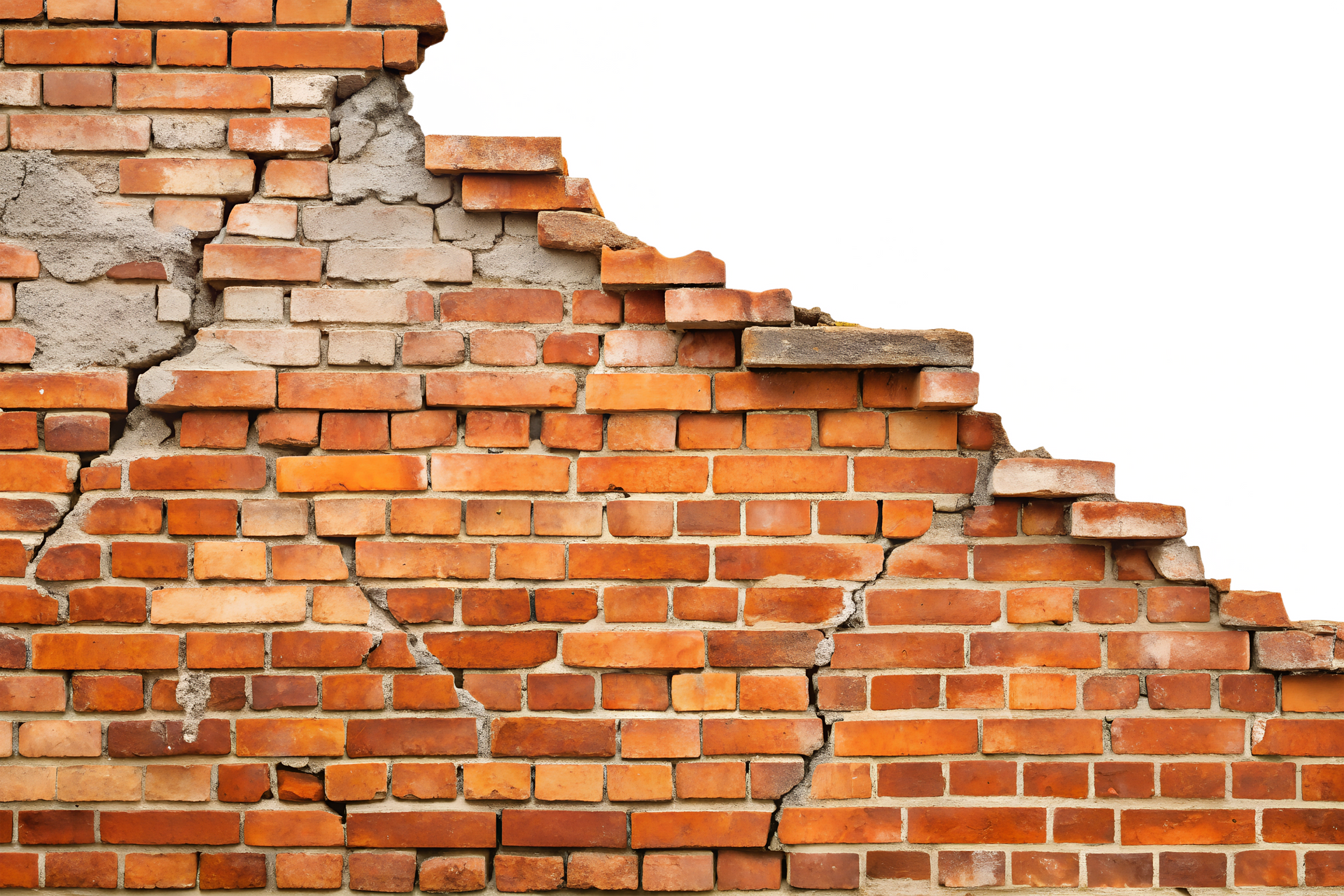

An earthquake insurance policy typically provides coverage in three key areas: dwelling, personal property, and additional living expenses. Dwelling coverage is perhaps the most critical, as it helps with repairs or rebuilding the structure of your home if it's damaged by an earthquake. Whether it's fixing the foundation, replacing the roof, or restoring walls, this coverage ensures that you won't face an overwhelming financial burden when disaster strikes. Given the high cost of rebuilding, having this safety net in place means you won't have to worry about shouldering all the expenses on your own.

Personal property coverage is another essential component of earthquake insurance. It helps replace the belongings inside your home, such as furniture, electronics, and appliances, if they're damaged in the event of an earthquake. Without this coverage, the costs of replacing everything could quickly add up, leaving you in a difficult position. By having protection in place, you're ensuring that your hard-earned possessions can be replaced without draining your savings.

Additional living expenses coverage is also vital, especially if your home becomes uninhabitable after an earthquake. This helps cover temporary living expenses, like hotel bills and meals, while your home is being repaired. It allows you to focus on recovering from the damage, knowing that your living situation is taken care of in the meantime.

Although earthquake insurance isn't a legal requirement, it's an investment that makes sense for homeowners who want to ensure that their home and future are secure. Your home represents more than just a place to live; it's where your family's memories are made and where your plans take shape. With earthquake insurance, you're proactively protecting your dreams and making sure that you're prepared for the unexpected. It's a smart step in securing your future, so no matter what happens, you can keep building the life you've worked so hard for.